Posted 28 Mar 2013

[HTML1]

What happens when a business cannot make payroll? Poof, the business vanishes! That is what happens.

This is a cautionary tale of a medium sized information technology business that is destined to fail because over $700,000 of working capital has been stolen resulting in their inability to make payroll, pay for current expenses and otherwise manage their business along with how they could have prevented this fatal business mistake when managing their current assets.

BANK HOLIDAY IN CYPRUS AND DEPOSIT CONFISCATIONS

Cyprus instituted a bank holiday at the behest of the European bureaucrats. While the banks were closed they confiscated depositors funds to bailout failed banks. As Time Magazine reported on 28 March 2013, "But Cyprus’ two biggest banks have been folded together, and their depositors and creditors are on the hook for the $7.5 billion “bail-in” that Cyprus itself must deliver as its contribution to the rescue package."

In other words, the Cyprus government and European bureaucrats have caused this business, and thousands of others, to vanish. Poof go the jobs. Poof go the livelihoods of all the employees. And poof goes the confidence in the banking system because Cyprus is not alone.

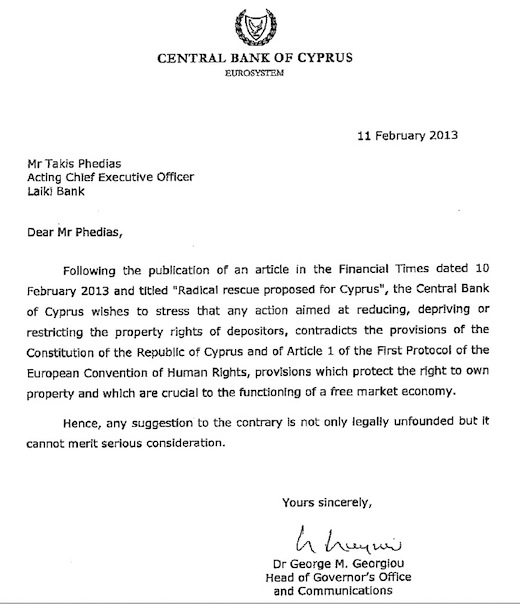

But one problem with the Cyprus government stealing deposits is that it violates the Constitution of Cyprus and the European Convention of Human Rights as Dr. George Georgiou, Head of Governor's Office and Communications for the Central Bank of Cyprus, wrote in a 11 February 2013 letter to Mr. Phedias the Acting Chief Executive Officer for Laiki Bank.

BANKS OF CANADA AND ENGLAND

The Bank of England and the Bank of Canada have both published similar 'bail-in' schemes for stealing bank depositor's funds. Western governments are getting increasingly desperate.

But now the banks have crossed a rather sacrosanct line. They have confiscated deposits. Deposits that were supposed to be insured. Deposits that were supposed to be risk-free. Deposits that are the life-blood of widows and businesses around the world. And the banks intend to spread this kleptocracy across the globe.

For example, Andrew Gracie the Director of the Special Resolution Unit for the Bank of England gave a speech on 17 September 2012 for at the British Banker's Association titled: A Practical Process For Implementing A Bail-In Resolution Power.

Bail-in, like other resolution tools, involves some interference with property rights. ... And bail-in, like the other resolution tools, can only be used when necessary to do so in pursuit of clearly defined public interest objectives. ... The Bank of England, alongside other domestic and international authorities, has been working to ensure that bail-in can be implemented effectively. Applying it will involved overcoming legal, operational and financial challenges. ... As described above, we are moving closer to an operational bail-in regime.

Another example is James Flaherty, Minister of Finance for Canada, in the Economic Action Plan 2013 where it states on page 145:

The Government proposes to implement a 'bail-in' regime for systemically important banks. This regime will be designed to ensure that, in the unlikely event that a systemically important bank depletes its capital, the bank can be recapitalized and returned to viability through the very rapid conversion of certain bank liabilities [NOTE: customer deposits!] into regulatory capital.

BITCOIN IS A VIABLE SOLUTION

Bitcoin is a decentralized digital currency that is censorship-resistant and has a money supply in excess of $1B. Like gold, Bitcoin is an equity based asset which means it is nobody's liability. Bitcoins held in a wallet can only be moved by the person who holds the private key. This means they cannot be seized, confiscated, frozen or otherwise impeded.

This means that businesses that begin integrating Bitcoin into their daily financial operations are able to immunize themselves against a bank holiday or 'bail-in' confiscatory scheme through disintermediation from the legacy bankrupt financial institutions.

[leadplayer_vid id="515399D6289D8"]

And doing so would actually be pretty easy with services like Local Bitcoins for local cash exchanges, the coming Bitcoin ATMs, Coinbase which links to bank accounts via ACH, Bitpay for processing transactions and easy conversion and daily ACH deposits in 11 currencies, Bit Spend for buying anything online, Expensify for expense reports and reimbursements and A Lawyer's Take On Bitcoin and Taxes for those who want to be tax compliant.

CONCLUSION

So, in conclusion, I am getting less and less sympathetic to those individuals and businesses that refuse to upgrade their money and currency systems and instead choose to lose their funds to kleptomaniacs because an easy to implement solution exists for them to protect themselves.

After all, Bitcoin users are not affected by these 'bail-in' thefts. Failure to embrace this new technology will cost employers and employees dearly. As we have seen from Cyprus, the entire business may just vanish! Business owners would be wise to remember the first rule of panic: Do it first!

Considering getting started with this new technology with the Free Bitcoin Guide.